Category: E-file 1099

- September 27, 2020

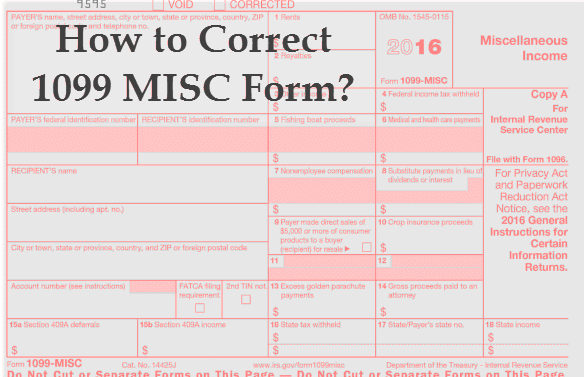

Form 1099-MISC reports all the non-employee compensation on every year-end summary. The IRS 1099-MISC Form covers royalties, independent contractor’s income, self-employment, rent,…

- September 14, 2020

The Internal Revenue Service provides many free tools for small businesses in order to help them understand and comply with the law.…

- « Previous Page

- 1

- …

- 3

- 4

- 5

- 6

- 7

- …

- 22

- Next Page »